-

Misclassification of Employees as Independent Contractors

Independent Contractor Law in San Jose, CA

Learn More About Employee Misclassification

Both employers and prospective employees should always be wary of misclassification as independent contractors. While many companies hire independent contractors within the bounds of the law, others stretch the rules and leave their employees at a disadvantage and themselves at great risk. Fortunately, the Advocacy Center for Employment Law is here to help guide parties to correctly assess whether a worker may be validly classified as an independent contractor. We work with clients throughout San Jose, CA and the surrounding communities. Our team is ready to evaluate your situation and best advise you how to proceed. Continue reading “Misclassification of Employees as Independent Contractors”

-

Covid-19 Unemployment Benefits in San Jose

As a result of the Covid-19 pandemic, you may qualify for extended unemployment insurance benefits, and enhanced protections from employer discrimination. If you believe that you or someone you know has been wrongfully fired due to actual or suspected infection, civil rights violations may have occurred, where the law is designed to protect the public from actual or perceived medical condition discrimination or disability discrimination. It is best to consult a qualified employment lawyer to be best advised if you suspect your rights have been violated.

If you’re in San Jose and need an attorney you can depend on to fight your case, contact Advocacy Center for Employment Law.

-

Sexual Harassment in the Workplace

What Is Sexual Harassment?

Employment law recognizes multiple types of sexual harassment in the workplace. For example, you might contact a sexual harassment attorney if another individual requests sexual favors or makes unwanted sexual advances. However, a wide range of other verbal and physical behaviors have been identified as forms of sexual harassment, such as crude jokes of a sexual nature. If you think you may have been the victim of sexual harassment, it’s important to get in touch with a sexual harassment lawyer as soon as possible.

Watch this video to hear more about this common workplace problem. This expert urges victims to be proactive by keeping a written record of all incidences of sexual harassment. This record will be helpful when your sexual harassment attorney files a claim on your behalf.

The Two Main Categories of Workplace Sexual Harassment

There are many possible manifestations of workplace sexual harassment. They typically fall into two main categories. The first is quid pro quo sexual harassment and the second is the creation of a hostile environment. If you’re unsure of whether your rights were violated, you can contact a sexual harassment attorney. Let your labor attorney know about all incidences of possible sexual harassment, and ask him or her any questions you may have about employment law.

Quid pro quo sexual harassment involves telling an employee that he or she must provide a sexual favor in exchange for job retention, promotion, or achieving some other benefit. Since quid pro quo sexual harassment often lacks witnesses and can be challenging to prove in court, it’s essential to work with a sexual harassment attorney who will thoroughly investigate the claim. The other type of sexual harassment involves a workplace that is characterized by the pervasiveness of behaviors that are sexual in nature, such as telling dirty jokes, making crude remarks, leering, or engaging in other undesirable behaviors.

The Effects of Sexual Harassment in the Workplace

A hostile working environment characterized by pervasive sexual harassment can make employees uncomfortable, to say the least. However, the serious effects of sexual harassment are often understated. These behaviors can cause significant health problems, financial difficulties, and even global repercussions. If you’ve encountered sexual harassment in the workplace, you have the right to consult a sexual harassment attorney. Your labor law attorney can explain your legal rights to you and discuss your options for obtaining damages.

1. Emotional Well-Being

Sexual harassment can jeopardize the victim’s emotional and mental health. It can lead to the loss of self-esteem and it may even compromise personal relationships. Sexual harassment in the workplace can cause significant stress and anxiety. An employment harassment lawyer is also likely to work with clients who have suffered from long-term clinical depression as a result of sexual harassment.2. Physical Health

Physical health and emotional health are closely linked. When victims of sexual harassment experience mental and emotional problems, it often leads to physical health issues, such as loss of appetite, headaches, weight fluctuations, and sleep disturbances. Sleep disturbances can, in turn, lead to other serious health problems, such as hormonal imbalance, an increased risk of high blood pressure, and a weakened immune system.3. Financial Challenges

In addition to causing health problems, sexual harassment frequently leads to financial challenges. It’s important to tell your sexual harassment attorney in San Jose about any financial consequences of sexual harassment, such as lost wages and unpaid leave. Some victims of sexual harassment may even face broader career repercussions, such as the loss of job references. They may decide to leave their current position or employer to avoid a hostile work environment.4. Global Consequences

Sexual harassment has a direct effect on employers and the global economy. Each year, millions are lost due to absenteeism, low productivity, employee turnover, low morale, and legal costs stemming from sexual harassment. The economy also suffers due to premature retirement and higher insurance costs.Signs You’re Being Sexually Harassed at Work

Employees often feel pressured to look the other way when sexual harassment occurs. If they voice their concerns, they may be told that the offensive behavior was nothing to get upset about. However, sexual harassment should never be ignored or condoned. If you feel that you’re being sexually harassed in the workplace, you can turn to a sexual harassment lawyer for help. Your labor law attorney may recommend that you keep detailed records of all instances of offensive behavior to support your claim.

1. You’ve Been Asked for a Sexual Favor at Work

Sometimes, sexual harassment is overt. You may have been asked for a sexual favor by a supervisor in exchange for a raise or a promotion. Or, you may have been told that unless you agreed to the sexual favor, you would be fired or demoted. Employment law recognizes this type of discrimination as quid pro quo sexual harassment. Although it may seem that it would be difficult to prove what someone else has told you, you’ll find that a sexual harassment attorney can bring powerful investigative tools to the case.2. You’ve Seen Offensive Images or Heard Offensive Remarks

Other types of sexual harassment are less obvious than quid pro quo sexual harassment, such as being subjected to offensive images or language. For example, a co-worker or supervisor may have sent an email containing inappropriate images or language. A co-worker might hang an offensive calendar in a workspace. These are all signs that you’ve been sexually harassed at work – even if the images were not sent directly to you. Additionally, bear in mind that some types of language may constitute sexual harassment even if it is not sexual in nature. For example, a supervisor might call the female employees by non-sexual, yet offensive names, while refraining from doing so to the male employees. This is also a form of sexual harassment.3. A Hostile Working Environment Makes You Uncomfortable

If you feel uncomfortable going to work, you may be the victim of sexual harassment. Employment law recognizes that not all acts of sexual harassment may be directed at a particular victim. Instead, your sexual harassment attorney may file a claim on your behalf based on the maintenance of a hostile work environment.If you’re in San Jose and need an attorney you can depend on to fight your case, contact Advocacy Center for Employment Law.

-

Employment Advocacy Attorney Steven P. Cohn Honored by His Peers

Few attorneys are more consistently recognized for their exemplary work than Steven P. Cohn, San Jose employment law expert at the Advocacy Center for Employment Law. And when that recognition comes from other lawyers, it means even more. Recently, Mr. Cohn was distinguished by his peers with a Very High Rating in Both Legal Ability and Ethical Standards.

The award was bestowed upon Mr. Cohn and the Advocacy Center for Employment Law by Martindale-Hubbell, a source of information for attorneys. Founded in 1868, the company publishes a directory of facts about attorneys and law firms. According to Mr. Cohn’s award plaque, the Peer Review Ratings “have been an integral part of Martindale-Hubbell’s services to the legal community since 1887. The rating process, which evaluates lawyers in the United States and Canada, is solely based on peer review.”

Mr. Cohn practices in San Jose and has more than 35 years of legal experience. He specializes in workplace discrimination and harassment, disability, whistleblowing, unlawful business practices, and wrongful termination. Congratulations, Mr. Cohn, for once again being recognized for your unquestionable value to your clients and your unwavering integrity as an employment attorney.

Call today for an award-winning employment attorney!

-

Top Employment Lawyer in San Jose

Recently, ThreeBestRated.com identified Steven P. Cohn as a leading provider in the field of employment law in San Jose. Based on reviews and testimonials, the company determined that Mr. Cohn stood out from other attorneys, and duly selected him as one of the top three employment lawyers in San Jose. Mr. Cohn has more than

35 years of legal experience and specializes in workplace discrimination and harassment, disability, whistleblowing, unlawful business practices, and wrongful termination . Congratulations on the recognition, Mr. Cohn!

35 years of legal experience and specializes in workplace discrimination and harassment, disability, whistleblowing, unlawful business practices, and wrongful termination . Congratulations on the recognition, Mr. Cohn!If you have benefitted from Mr. Cohn’s legal expertise, please leave a review on our Google+ page. We appreciate your feedback!

-

Attorney Steven P. Cohn Honored with Prestigious Award

We are proud to announce that Steven P. Cohn has been recognized for the prestigious National Advocates Top 100 Lawyers .

The National Advocates Top 100 Lawyers seeks to identify the top 100 attorneys who exemplify their duties as they represent individuals in their legal specialties. These attorneys demonstrate leadership, influence in their community, and premier performance.

The Advocacy Center for Employment Law specializes in employment and labor law with a focus on harassment and discrimination litigation. The firm also addresses civil rights violations, unfair business practices, workplace sexual harassment, and unlawful discrimination.

-

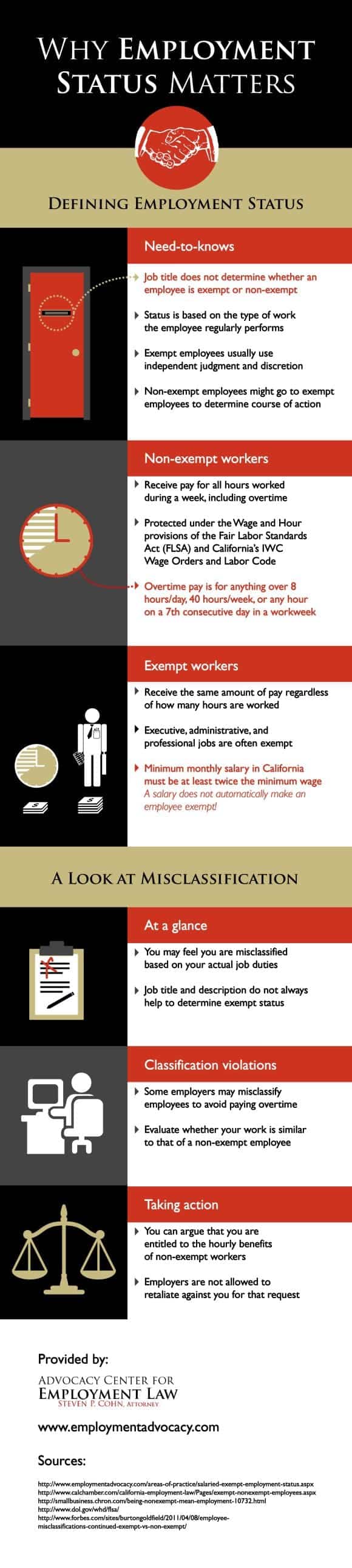

Why Employment Status Matters [INFOGRAPHIC]

If you’re like most people, you work hard at your job to make a living and provide for yourself and your family. No matter what industry you enter, your employer should be classify you as either an exempt or non-exempt employee. Non-exempt employees are entitled to overtime pay for time worked more than 40 hours per week, while exempt employees are paid the same amount, regardless of time worked. If you are an exempt employee in San Jose but feel you are entitled to the same benefits as a non-exempt worker, you may need an employment lawyer to get you the wages you deserve. Take a look at this infographic to learn more about employment status, and to learn why your classification matters. Please share with your friends and family.

-

Steps to Take If You’ve Been Misclassified as an Independent Contractor

California laws provide protections and relief for workers that have been misclassified as an independent contractor. Classifying employees as independent contractors offer companies significant savings, since they do not need to pay the employer-portion of Medicare and Social Security taxes, nor do they need to provide workers’ compensation insurance, unemployment insurance, and other rights and benefits, such as overtime or meal and rest breaks. If your employer has been treating you as an employee, yet has been classifying you as an independent contractor, you should consult an employment lawyer for clarification about your rights, time limits, and possible recovery.

1. Discuss the Matter with Your Employer

If you have a good relationship with your employer, you may wish to ask them to review your classification. If your employer decides not to reclassify you or refuses to review your classification, try to obtain an explanation, preferably in writing, as to why your employer has classified you as an independent contractor. If you still think that you should be classified as an employee, contact an employment lawyer to discuss your options and to review your employer’s explanation.

2. Factors that Determine Whether you are an Employee or Independent Contractor

There is no set definition of the term “independent contractor”. In handling a matter where employment status is an issue, the DLSE presumes that you are an employee. Your employer must present evidence to rebut this presumption in order to show that you are properly classified as an independent contractor. After looking at all of the evidence, a judge will then apply a number of factors, all of which must be considered, and none of which is controlling by itself. These factors are sometimes referred to as the “economic realities” test.

In applying the “economic realities” test, the most significant factor to be considered is whether the person to whom service is rendered (the employer or principal) has control or the right to control the worker both as to the work done and the manner and means in which it is performed.

Additional factors that the DLSE may consider are:

-

Whether the person performing services is engaged in an occupation or business distinct from that of the principal;

-

Whether or not the work is a part of the regular business of the principal or alleged employer;

-

Whether the principal or the worker supplies the instrumentalities, tools, and the place for the person doing the work;

-

The alleged employee’s investment in the equipment or materials required by his or her task or his or her employment of helpers;

-

Whether the service rendered requires a special skill;

-

The kind of occupation, with reference to whether, in the locality, the work is usually done under the direction of the principal or by a specialist without supervision;

-

The alleged employee’s opportunity for profit or loss depending on his or her managerial skill;

-

The length of time for which the services are to be performed;

-

The degree of permanence of the working relationship;

-

The method of payment, whether by time or by the job; and

-

Whether or not the parties believe they are creating an employer-employee relationship may have some bearing on the question, but is not determinative since this is a question of law based on objective tests.

The DLSE will also find an employer-employee relationship if (1) the employer retains extensive control over the whole job operation, (2) the employee’s duties are integral to the operation, and (3) the nature of the work would not require detailed control.

The DLSE will also find an employer-employee relationship if (1) the employer retains extensive control over the whole job operation, (2) the employee’s duties are integral to the operation, and (3) the nature of the work would not require detailed control.Speaking with an employment lawyer about these factors is critical , as their experience with past clients, and their knowledge of other cases, can help think of creative ways to fit you within these factors and establish your status as an employee.

-

-

A Closer Look at California Overtime Laws

Overtime pay is generally owed to all non-exempt employees who work more than eight (8) hours in a work day, or more than forty (40) hours in a work week, or for any hours worked on a seventh (7th) consecutive day of a work week.

1. How Is Overtime Compensation Calculated?

Employees who are entitled to overtime must receive at least one and one-half times their regular hourly rate of pay for overtime hours that they work. If the employee works longer than twelve (12) hours in one day, or over eight (8) hours on a seventh (7th) consecutive day of work, they are entitled to overtime at a rate of double their regular hourly rate of pay (sometimes referred to as “double-time” instead of “overtime”).

Since there are complicated exceptions and exemptions to California’s overtime law, you should contact an employment attorney if you believe that you are owed overtime for hours that you have worked.

2. How Can I Recover Overtime Wages an Employer Refuses to Pay?

If you worked overtime hours, but you did not receive compensation equal to what is described above, your employer may owe you back pay and may also be required to pay certain penalties to both you and the State. California provides workers with a free, streamlined administrative process to recover back pay, other wages, and penalties through the Labor Commission, under the Division of Labor Standards Enforcement (DLSE). An employment attorney can help you file a Claim with the DLSE, and represent you at the mandatory Conference and Hearing.

-

Salaried Workers and Overtime: What You Need to Know

Are you considered an exempt employee in San Jose? If you are a salaried worker, you might assume the answer to be yes. Many people do, and as a result, they are denied the compensation they are owed for their overtime hours. Overtime pay is a right not just for hourly workers; salaried employees may also be eligible for this type of income depending on their employment status. Knowing whether you are accurately classified as an exempt or non-exempt employee is the first step towards receiving the compensation you deserve.

Are you considered an exempt employee in San Jose? If you are a salaried worker, you might assume the answer to be yes. Many people do, and as a result, they are denied the compensation they are owed for their overtime hours. Overtime pay is a right not just for hourly workers; salaried employees may also be eligible for this type of income depending on their employment status. Knowing whether you are accurately classified as an exempt or non-exempt employee is the first step towards receiving the compensation you deserve.1. Employment Status

Workers’ rights vary depending on whether you are an exempt employee or a non-exempt employee. The category that you fall into depends on the nature of your position. For instance, if you have an administrative or executive title, you may be exempt from overtime pay. However, many other positions carry a non-exempt status. One of the easiest ways to determine if you are a non-exempt employee is to track whether your wages have ever been reduced because you arrived late to work one day or had to leave early to pick up your child from school. If so, you are likely a non-exempt employee.

2. Overtime Stipulations

Under most circumstances, overtime pay is due to non-exempt employees who work more than 8 hours in a day, 40 hours in a week, or seven consecutive days in one workweek. Regardless of whether you work only a single hour past 40 hours once a month, or you regularly work 10 hours or more past 40 in a single week, you have the right to overtime pay.

3. Pay Request

Asking your employer to provide legitimately owed overtime pay is your right, but it should be done with the proper precautions in place. First, you should submit your overtime request with written documentation. Second, you may want to contact an employment attorney before you move forward with your request. A labor lawyer is well versed in workers rights and can help you get the wages you are due. Should your employer dismiss you for your overtime pay request, an employment attorney could prove integral to getting capable legal representation and a fair settlement for a wrongful termination claim.